Best Pet Insurance Companies

Healthcare costs in the world are increasing every day. With medicines getting expensive, doctor fees also increasing day by day, we need more support to pay them. This was the reason behind health insurance. The same is true for your pet and the need to look for the best pet insurance companies.

More people are keeping pets now. Since they need more services, vets charge you a lot of money for a single checkup. In this condition, it is difficult for pet owners to afford these bills. Thus, you must find the best pet insurance companies’ services to sponsor your pet’s health payments.

Why Do I Need Pet Insurance?

Pet insurance will save you in case of emergencies and scenarios where you need money. This could be in terms of vet bills or other expenses. You will pay the amount to the vet and sign the receipts. The insurance company will pay you the amount after you present those receipts.

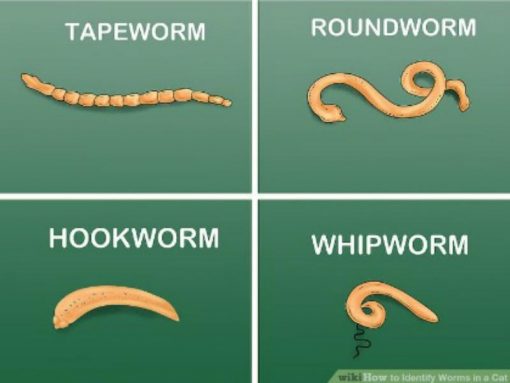

Pet insurance usually covers a lot of things. You may learn about it in detail in the section “types of pet insurance.” In any case, pet owners face many issues when their pet develops an illness or after an accident. You may want to treat your pet from the best vet, but it may exceed your budget.

Pets in their older age develop a lot of chronic issues. You also need a lot of money to treat them. So, you need the best pet insurance to help you bear all these expenses. You have the freedom to visit any vet as long as he is licensed to do so.

Problems in Pet Insurance

Unlike human insurance, pet insurance is a new field. You will face some basic issues even in the best pet insurance companies. The first issue that you will face is finding the right type of insurance plan. Insurance companies will charge you a higher premium if your pet is older. The reason is that older pets have more chronic issues and companies fail to invest in them.

Another common issue is to find an insurance plan if your pet already has some disease. The company will exclude that disease from their plan and will cost you a lot of money. There are delayed times before the insurance company accepts your claim and decides to pay your money. Some pet owners have to wait for even two to three months. No plan will cover all costs. These were some common problems in pet insurance.

Types of Pet Insurance

Many companies offer pet insurance, but each of them differs from one another. So, you must know which one to accept and which one to reject. We will see a different type of pet insurance here. So, you can decide which type suits the best for your pet.

Accident-only

One of the basic types of insurance for your pet is an accident only. This plan will cover expenses that are related to some accident. It may be a road accident or other incidents like burns or broken bones. These are basic plans and are very helpful in controlling your sudden expenses. However, they will not cover illness expenses. If you have a pet who runs a lot and explores different stuff, this plan is best for him.

Wellness Plan

If you are a person who loves to carry your pet for routine checkups, then you must opt for a wellness plan. This plan will not cover any specific illness. Rather, you can use a wellness plan to treat annual checkups, vaccines, preventive measures, and related medical expenses.

Time-Limited

If you need the cheapest type of pet insurance plan, then go for a time-limited plan. This type of plan has two caps placed on it. There is a spending cap, and at the same time, there is a time limitation. As soon as you achieve the first cap, your policy will finish. Thus, you won’t get any extra income.

We can explain it with the help of diabetes. If your pet gets diabetes, the insurance will start covering it. Assume the plan has a cap of $10K and 365 days. If you spend all the amount, the plan is finished, and you won’t get any more money. If the treatment exceeds 365 days, the plan is again finished. You will not get any money after that time. Since they suit the provider, they are very affordable.

Max Benefits

Even if the time-limited plan is affordable, most people are reluctant to apply it. The reason is that it is a win-win for the provider and a loss for the pet owner in most cases. So, pet owners usually prefer to invest in a tax benefit policy.

In this type of policy, there is no time limit. There is only a single cap that is related to the amount of money. Suppose your plan consists of a $10K treatment on the pet. The provider will keep giving you money unless you use all the amount. Since this method supports pet owners, it costs a lot for you.

Lifetime Insurance

If your pet is facing some serious health issues, then no cap amount may prove enough for them. There could be situations like diabetes, chronic illness, expensive surgeries, and related illness. In this case, it is better to opt for life insurance for your pet.

This type of policy will bear your pet’s expenses during their whole life. Pet insurance is still in the early stages; so, they are not mature yet. Even still, you will get some of the best types of insurance deals in this section.

How to Buy the Best Pet Insurance?

We discussed the major type of insurance plans that are available to select. However, you are the right person to decide which one is better. You will see which plan suits you better and then will opt for the specific plan. Let us discuss all the factors that matter when selecting the best pet insurance companies.

Monthly or Annual Premiums

The first thing that you must see is whether you opt for monthly premiums or annual ones. You have to choose whether you want to pay a small amount as a premium or a large one. If you pay a large premium, it means that your deductible will be small.

You can decide whether you want to pay monthly or annual premiums. Annual premiums may charge you less as compared to monthly ones. If you pay a large sum in premium, the insurance company will even agree to pay other health expenses. It includes lab payments, medicines, etc.

Some people select lower premiums. In this case, the insurance company will take their share in the form of a large deductible. However, you will get fewer benefits. So, we will urge you to select payment with large premiums and more benefits.

Deductions

Deductible means the amount that you will pay at the start of each year. Your insurance cycle won’t start unless you pay this amount. The companies usually give you freedom in selecting any amount as a deductible. They calculate premiums based on this amount.

If your pet has fewer health issues, you can even opt-out of annual payments. For these pets, there is an offer to pay at the start of the illness. So, if your pet suffers from diabetes, you will pay a specific amount at the start as a deductible.

Coverage

When it comes to coverage, the first thing to consider is what your plan doesn’t cover. No plan covers it all, and you must know the conditions that will leave you paying the amount. So, if you think that you will rarely face that condition, then opt for the program. However, if that’s a common issue for you, then reject that plan.

Most plans will either not cover previous illnesses or issues. Almost all the plans exclude medical issues related to pregnancy. There are many conditions in any plan, and you must know about all of them.

Benefit Limits

In the majority of pet insurance plans, there is no unlimited benefit. There are some upper limit caps on your plans to restrict your claims. It could be in the form of a time limit or amount limit. In some cases, the provider will even place both limits on your claim.

You must note that every limit on your benefit means cost saving for you in terms of premiums. If the provider has placed limits on the amount and time, it will be less costly for you. However, you must consider that a limit doesn’t impact your claim. If your pet has a long-term disease, then never opt for a time limit.

No plan comes with unlimited benefits. However, it would help if you took them in such a way to achieve max benefits for your pet. The best way is to avoid limits and claim benefits.

Exclusions

When you are signing a plan, you must consider all the items excluded from your plan. It could be in the form of lab services, vet fees, medicines, medical food, or a specialist vet. You must know which service matters for you and which service is less relevant. So, you can exclude useless deals to save money.

Waiting Periods

The best pet insurance companies work in a different way than insurance for humans. Here the companies don’t interact with vets. You will pay the vet and get a receipt. You will present the receipt before the insurance company, and they will approve your amount.

They verify your claim, perform some checks, and will delay your payment by several months. 2-3 months delay is a common delay. Even in some serious illnesses, you may have to wait for a year before the company approves your payment. You can take reviews from former reviews and select a company with a small wait.

Customer Service

When you are working with pet insurance companies, you must have basic knowledge. This will allow you to deal better with them. There are a lot of odds in the medical of your pet. So, always select a company with better customer service.

FAQs

Is Pet Insurance Worth It?

Most people never consider but having a pet cost you a lot of money. When they get ill, you have to spend on their medical. Like humans, there are some best pet insurance companies to cover your vet expenses. If your pet is from a breed that gets diseases often, then pet insurance is crucial for you.

What Is the Monthly Cost of the Pet Insurance Premium?

There is no fixed monthly premium for your pet insurance. It depends on the type of insurance, coverings, exclusions, type of company, and deductible amount. However, you should expect to spend between $30 to $50 on your pet insurance on average.

What if a Vet Doesn’t Accept My Pet Insurance?

Pet insurance doesn’t work in a way that is common for you. These are different and have their methods. Pet insurance companies don’t deal with vets directly. You will pay the amount and claim it after payment from the company. Thus, no vet either accepts or rejects your insurance.

What Is the Right Age for Pet Insurance?

The best age to select pet insurance is the early age of your pet. It could be any age before it gets three years old. Once your pet is aged, it will be hard to find a good plan for him. Aged pets develop a lot of diseases, and any plan at that time will be expensive.

Conclusion

Pet insurance is a new topic on the market. The best pet insurance companies are also starting to make new rules every day. So, we tried to present a complete guide based on all the information available. Thus, we made sure that you get the best plan for your pet.